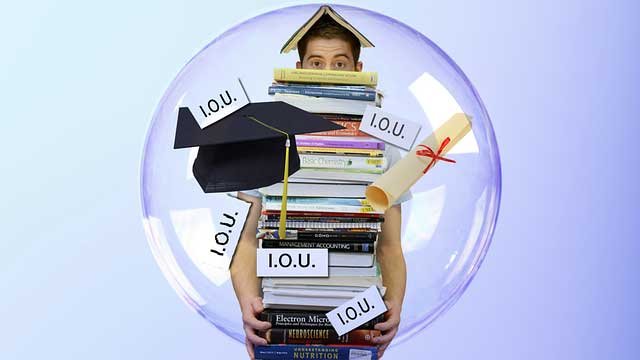

To be able to compete within the financial system of tomorrow, many younger Individuals might want to earn a complicated diploma — round 65 p.c of all jobs in the US would require some post-secondary schooling by 2020. However wages haven’t grown considerably over the previous a number of years, and pupil debt holders are being pinched.The end result: Greater than 30 p.c of pupil mortgage debtors are in default, late or have stopped making funds after simply six years.

CNBC cites experiences that inside six years, greater than 15% of pupil debtors had formally defaulted, whereas 10% extra had stopped making funds and one other 4.8% have been at the least 90 days late. And for-profit faculties fared even worse, the place almost 25% of graduates defaulted, and a complete of 44% confronted “some type of mortgage misery.”

These traits have been masked by Division of Schooling experiences which stopped monitoring compensation charges after simply three years (reporting defaults charges of simply 10%), in response to Ben Miller, senior director for post-secondary schooling on the left-leaning Middle for American Progress. “Official statistics current a comparatively rosy image of pupil debt. However taking a look at outcomes over extra time and in better element reveals that lots of of hundreds extra debtors from every cohort face troubles repaying.”