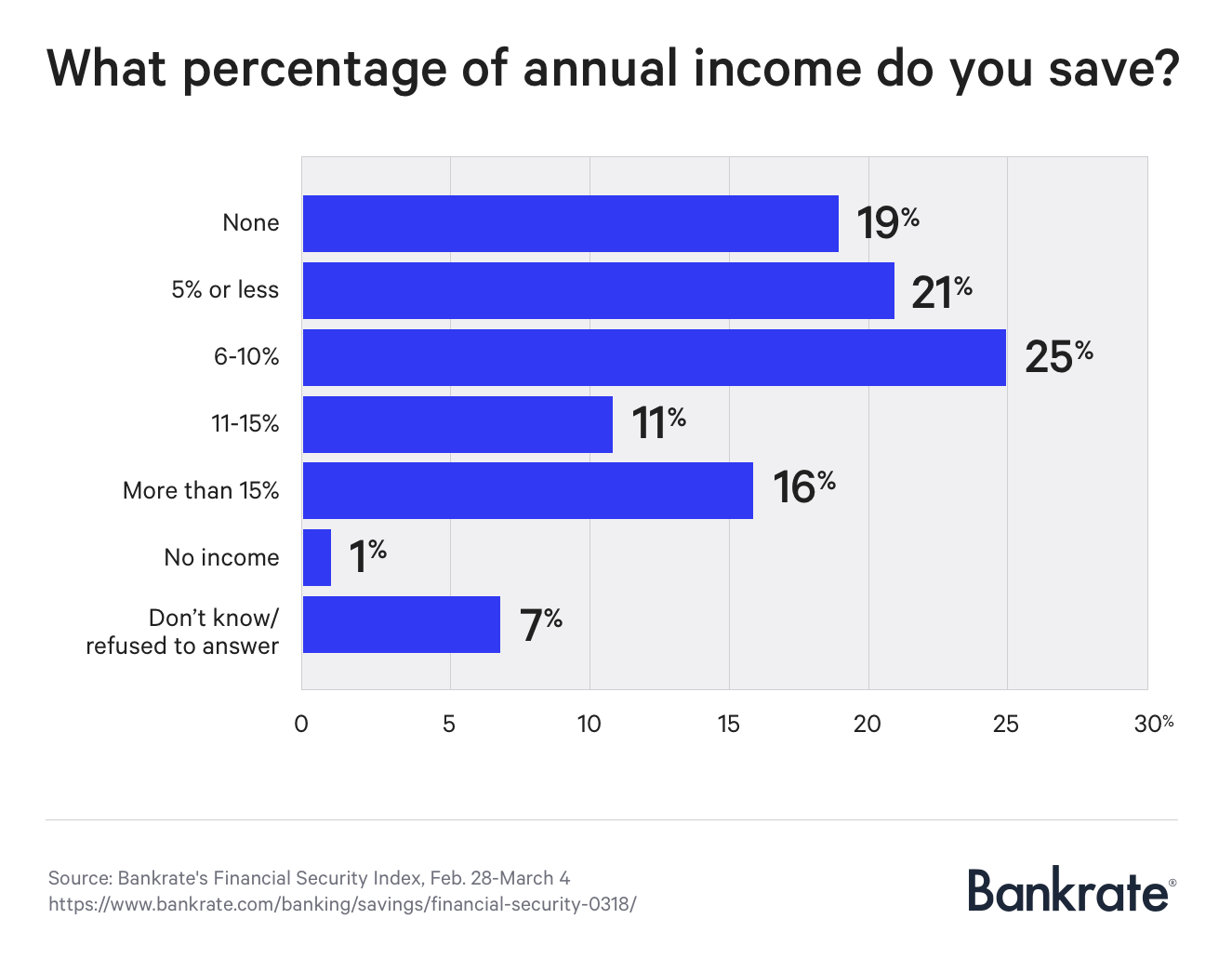

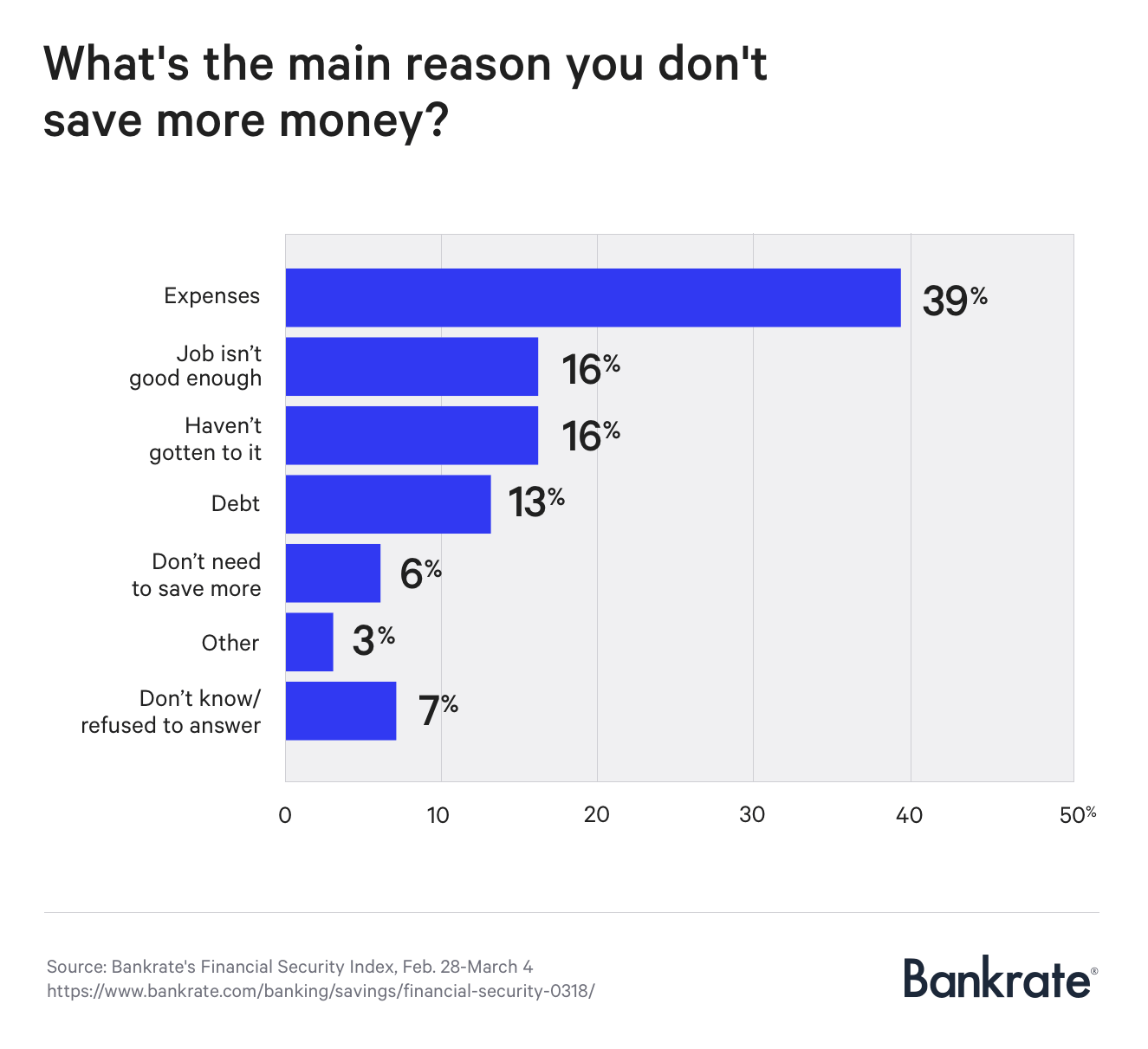

Regardless of a low unemployment fee and stronger economic system, 20 % of Individuals don’t save any of their earnings in any respect and even those that do save aren’t placing away sufficient for retirement. Based on a new survey from Bankrate.com, one-fifth of Individuals are including nothing to their financial savings. Amongst respondents, 2 in 5 cite life’s excessive bills, whereas one other 1 in 6 blame their crummy job.

“With a gentle, important share of the working inhabitants saving nothing or comparatively little, it’s nearly assured that they’ll be unable to afford a modest emergency expense or finance retirement,” says Bankrate senior financial analyst Mark Hamrick. “That quantities to a monetary fail.”

Bankrate additionally experiences that the common American has lower than $5,000 in a monetary account, 1 / 4 to a fifth of what it is best to have, and people aged 55 to 64 who’ve retirement financial savings solely carry $120,000 – which received’t final lengthy within the absence of paychecks.