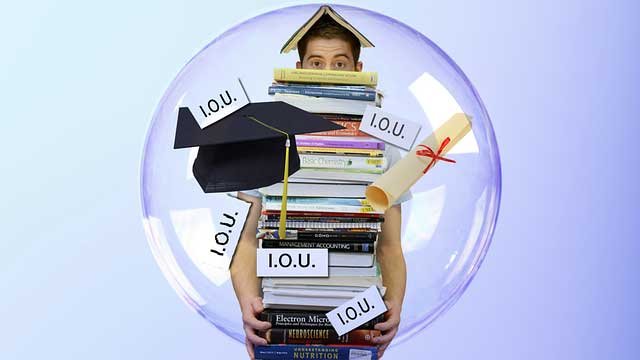

With over $1.3 trillion excellent loans, pupil mortgage debt is the second highest type of debt after residence mortgages, and the class of 2015 was probably the most indebted ever with the typical of over $35,000 for 70% of graduates. Nonetheless, there are choices for these scuffling with pupil mortgage debt. The methods to remove or get monetary savings on pupil debt are by pupil mortgage refinance, pupil mortgage forgiveness and public service mortgage forgiveness. Whereas pupil mortgage debt might be overwhelming, however there are alternatives so that you can deal with it. (huffingtonpost.com)