In the event you assume that investing is just for the wealthy and for individuals who are effectively off, you’re improper. Investing is for everybody. After all, when you’ve got lots of money, there are extra funding choices obtainable for you. Nevertheless, with as little as $1,000 you can begin your individual funding portfolio.

This text will present you easy methods to begin your funding and the place to place your cash to maximize your returns whereas minimizing prices. A journey to monetary independence begins with a single investing step. Begin your funding immediately. Don’t wait!

Ought to You Begin Investing Now?

You wish to put money into the inventory market to construct wealth in your future. Investing is comparatively easy and painless. In the event you don’t plan to reside paycheck to paycheck for the remainder of your life, you wish to begin saving and investing now. Over time you’ll have much more cash to meet your monetary dream corresponding to retirement, schooling and leisure.

However earlier than you create your first funding portfolio, there are some things you need to think about.

Ensure you sort out any high-interest money owed first. Begin paying off all these bank card money owed earlier than placing any of your cash to work in an funding portfolio. Paying off high-interest debt first additionally is sensible since you’ll earn greater than the inventory market by getting a assured return from eliminating your curiosity funds.

You also needs to reap the benefits of your employer’s matching contributions earlier than beginning exterior investments. The match contribution is like free cash, your absolute best funding. No different funding can provide that.

The place to Make investments with as little as $1,000?

You might want to open a brokerage account from funding corporations corresponding to Constancy, Charles Schwab and Vanguard. In your funding, you wish to avoid particular person shares as they’re missing diversification. Placing your cash in Vanguard’s low-cost index funds that monitor market benchmarks is a brilliant resolution.

Vanguard Goal Retirement Funds have a low $1,000 minimal for opening an funding account. With Vanguard Goal Retirement Funds, you get a whole portfolio in a single fund with a median expense ratio of solely 0.13%, 60% decrease than funds with comparable holdings. If you’re paying much less in your funds, extra money stays in your account working for you.

Vanguard Goal Retirement Funds has a date laid out in its identify corresponding to Vanguard Goal Retirement 2045 Fund. The funds do the rebalancing be just right for you by beginning with allocation favoring shares in early years of an investor’s life cycle, sometimes 90% shares and 10% bonds. They turn into extra conservative over time by shifting the asset allocations from equities towards mounted earnings.

Which Goal Retirement Fund Matches Your Timeline?

Vanguard Goal Retirement Fund is designed so that you can choose the fund that corresponds to the yr you count on to retire. Discover out by beginning with both the variety of years till you count on to retire or your present age. Then choose the suitable Goal Retirement Fund you consider finest matches your time-frame. As an example for those who simply begin your profession and have over 40 years earlier than retirement, you would possibly select Vanguard Goal Retirement 2055 Fund together with your preliminary $1000. . The fund begins out with 90% of its property allotted to home and worldwide shares and the remaining 10% in bonds.

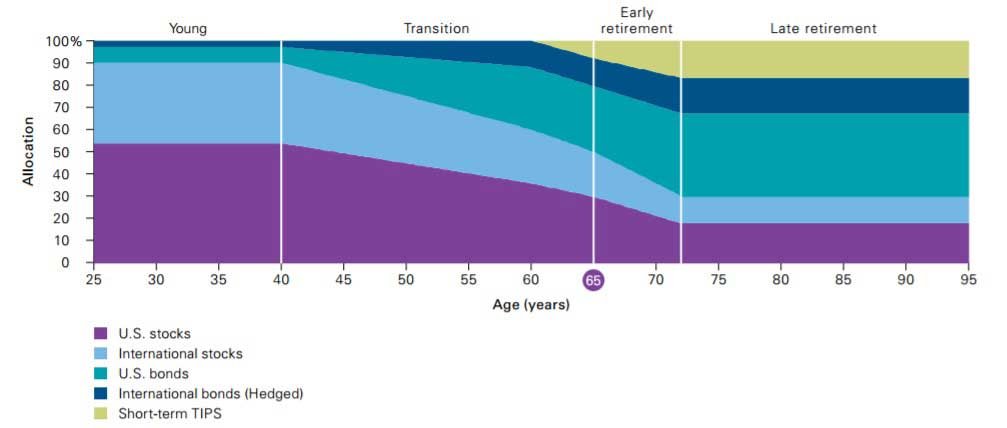

Glide Path for Vanguard Goal-Date Funds

Asset allocation—the share of a portfolio invested in varied asset courses corresponding to shares, bonds, and money investments—is an important determinant of the return variability and long-term efficiency of your portfolio.

Vanguard Goal-Date Funds keep a big stage of fairness publicity (90%) to age 40 as a result of one’s human capital stays so dominant over the small balances in monetary capital throughout the early phases of asset accumulation. After age 40, the fairness allocation continues to say no till age 72 to compensate for the shifting stability between human and monetary capital.

As you add extra money towards your funding portfolio, finally you’d wish to write up your individual Funding Coverage Assertion together with your private funding goal and asset allocation. By then you may design your individual portfolio’s glide path as an alternative of counting on Goal-Date Fund’s glide path.