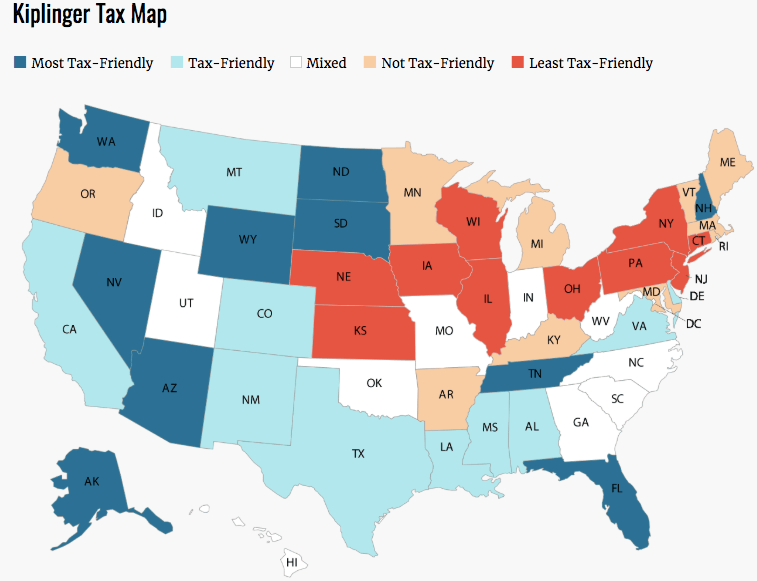

Private finance website Kiplinger simply launched its listing of essentially the most and the least tax-friendly states in America. To find out how huge of a tax chunk every state would take out of your hard-earned money, Kiplinger used a hypothetical couple with two youngsters and $150,000 in revenue a 12 months plus $10,000 in dividend revenue, after which checked out their revenue, property and gross sales tax burden.

A number of the most tax-friendly states don’t have revenue tax together with Wyoming, Nevada and Florida. Tennessee has revenue tax however it solely applies to curiosity and dividends and doesn’t apply to salaries and wages.

The ten most tax-friendly states:

1. Wyoming

2. Nevada

3. Tennessee

4. Florida

5. Alaska

6. Washington

7. South Dakota

8. North Dakota

9. Arizona

10. New Hampshire

As for the least-tax pleasant states, Illinois took the No. 1 spot on the listing attributable to their very excessive property taxes. Each Connecticut and New York, which have fairly excessive revenue taxes, are subsequent on the listing. Surprisingly California didn’t crack the highest 10 least-friendly tax states attributable to Kiplinger’s calculation methodology.

The ten least tax-friendly states:

1. Illinois

2. Connecticut

3. New York

4. Wisconsin

5. New Jersey

6. Nebraska

7. Pennsylvania

8. Ohio

9. Iowa

10. Kansas