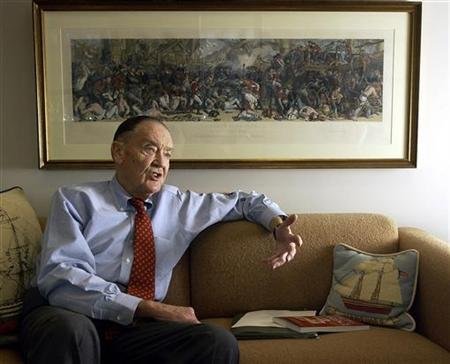

In response to Vanguard Group founder Jack Bogle, U.S. shares are nonetheless one of the best and traders don’t have to take any threat exterior of the U.S. for large returns. “I imagine the U.S. is one of the best place to take a position,” Bogle advised Bloomberg. “I’d wager that the U.S. will do higher than the remainder of the world. It’s a easy wager on which financial system goes to be the strongest in the long term.”

In actual fact, Bogle, who began the primary index fund in 1976, put all of his funding in U.S. securities, with shares and bonds having an equal share of his index portfolio.

One factor Bogle realized from his extraordinarily lengthy profession within the funding world is to not observe the group. “Each single particular person I believe I’ve ever talked to tells me I’m improper on this,” Bogle mentioned. “In case you imagine within the majority, you possibly can simply throw my opinion within the waste basket. However then again, I used to be introduced up on this enterprise and I’m saying ‘the group is all the time improper.’”

Since 1993 the S&P 500 Index has jumped greater than 421 %, greater than 4 instances the efficiency of MSCI’s index of world equities excluding the U.S. “I don’t assume in the long term [emerging markets] will do in addition to the U.S.,” he mentioned. “They’re extra dangerous and extra delicate to rates of interest, extra delicate to Federal Reserve statements and actions. They don’t have the variety now we have within the U.S.”

Information additionally present that cash flowing into rising markets and Europe this yr dwarfs what’s flowing into the U.S. It’s smart for traders to purchase U.S. indexes. Why mess with what’s labored? Ignore the group and stick to U.S. shares.